Consolidated Account of Condition and you will Income to have 4th Quarter 2024

Articles

You might’t make use of your PTIN instead of the newest EIN of one’s taxation planning company. The newest Internal revenue service isn’t accountable for a lacking reimburse for those who enter the incorrect username and passwords. Speak to your lender to obtain the correct routing and account numbers also to make sure that your head deposit might possibly be recognized. For individuals who pay by EFT, charge card, otherwise debit card, document their go back with the Rather than a payment address below In which To help you Document , earlier, and you can wear’t document Mode 945-V, Percentage Discount.

Q4 Financial Style: Financing Gains, Enhanced Net gain, Large Unrealized Losings

The new punishment to have not paying taxation whenever owed is usually one-half step 1% of your own delinquent income tax for each and every day otherwise section of a week the new income tax try delinquent. For individuals who is attention or penalties together with your commission, choose and go into the amount at the end margin away from Setting 1042. Don’t were interest otherwise charges on the balance on the range 69.

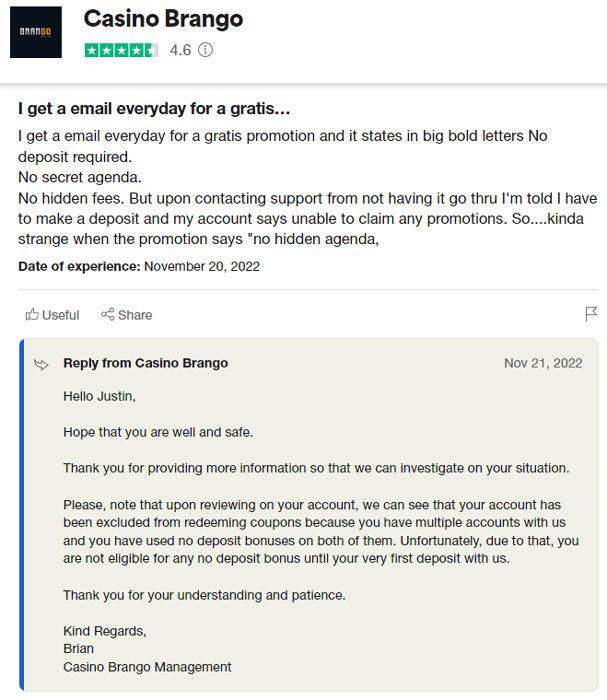

Should i win real money that have a no deposit casino incentive?

A reporting agent helps give payroll and payroll-associated taxation obligations on behalf of the brand new boss, in addition to authorization in order to digitally sign and you can file forms set forth to the Setting 8655. An employer uses Setting 8655 in order to authorize a reporting agent to perform features on behalf of the newest boss. A revealing agent works this type of services using casino mr green reviews play online the EIN of your boss. A reporting broker isn’t accountable while the either a manager otherwise an representative of your employer to your employer’s work taxes. If an employer is using a revealing broker to perform its taxation requirements, the newest employer remains liable for their a job loans, in addition to accountability to own a career taxes. Basically, you could potentially take a card facing your own FUTA income tax to have quantity you repaid on the county jobless fund.

Unify Financial Credit Connection — $150

Extent inserted online 7m have to equal the amount stated on the web step 3. If the line 6a try lower than $1, we are going to publish a refund or use it for the 2nd go back only when you ask us on paper to do so. If the zero product sales otherwise transfer took place, or if you wear’t be aware of the name of the individual so you can which the firm are marketed or transferred, one truth might be as part of the statement. Install an announcement to the return aided by the following guidance. Modifying from one kind of team to a different, including from an only proprietorship to a partnership otherwise firm, is considered a move.

Finest Delivery Jobs Applications to make Additional money

Brokers giving $step 1 places generally provide small, cent, or scholar accounts designed for lower-frequency change. An excellent $step one lowest put means that you could unlock a trading and investing account that have as low as $step 1. This really is generally offered by brokers to really make it easier for the fresh or quick-level people to start change with reduced economic relationship.

All of our writers is committed to providing you with independent reviews and you will information. We have fun with investigation-motivated techniques to check on lending products and you can enterprises, thus are typical counted equally. Look for more info on all of our editorial advice as well as the financial methodology to the analysis less than. People who didn’t discovered a notification letter otherwise a credit card applicatoin packet continue to have to utilize, however they have until Nov. 30, 2024 to accomplish this.

- Typically the most popular while the greatest sportsbook, Bovada boasts a large number of games across additional kinds.

- The newest FUTA income tax relates to the initial $7,000 you only pay to each and every staff through the a season once subtracting one payments exempt away from FUTA taxation.

- When you yourself have a current account, you must put an extra $10,100000 to the current balance during subscription.

- An enthusiastic Archer MSA and a keen HSA can also be discover just one rollover contribution through the a-1-12 months period.

- For many who’re also eligible to the utmost 5.4% borrowing, the brand new FUTA taxation rates after borrowing from the bank are 0.6%.

Minnesota’s Protection Deposit Rules are full of secret specifications one to tenants and landlords need to be familiar with. Prepare for a keen enlightening dive on the extremely important regions of Minnesota’s Defense Put Legislation. An important purpose of a protection put is always to include the brand new landlord’s possessions away from ruin past regular deterioration and defense any outstanding lease.

If each other penalties implement in every few days, the new FTF punishment try smaller from the quantity of the fresh FTP penalty. The new charges won’t be billed if you have sensible cause of failing to file or pay. For individuals who found a penalty see, you might give an explanation of exactly why you trust practical result in can be acquired. A responsible individual also can is one who cues checks to own the business if not provides power result in the brand new investing out of business financing. To learn more, for instance the concept of a motion picture venture company and you will a movie endeavor personnel, see point 3512. Public shelter and you may Medicare taxes features other prices and only the new social shelter tax provides a salary base limitation.